CamiForm: Your Source for Diverse Insights

Exploring a world of information across various topics.

Climbing the Cashback Ladder: How Loyalty Tiers Can Boost Your Wallet

Unlock your savings potential! Discover how loyalty tiers can elevate your cashback game and put more money in your wallet.

The Ultimate Guide to Understanding Loyalty Tiers and Cashback Rewards

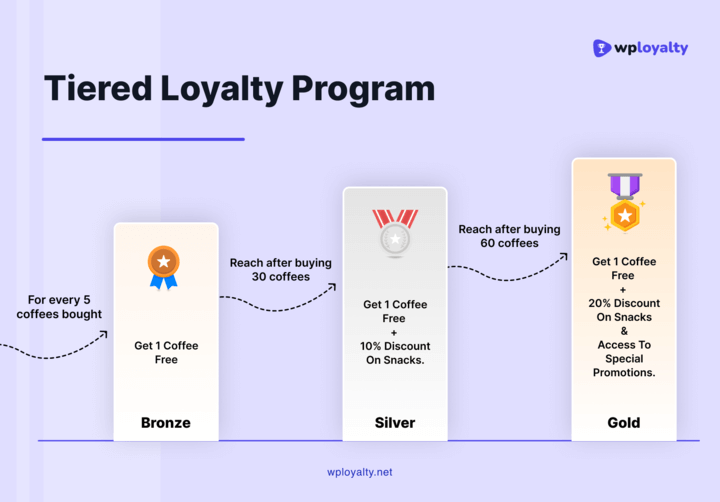

Understanding loyalty tiers and cashback rewards is crucial for maximizing the benefits of your spending. Loyalty programs are often structured in tiers, which means that the more you spend, the higher your tier and the better your rewards. Loyalty tiers can come in several levels, often labeled as Silver, Gold, and Platinum, each offering increasing benefits. For example, a Gold tier member might earn double points on purchases compared to a Silver tier member. This tiered approach incentivizes customers to spend more to unlock greater rewards, which could include not only cashback but also exclusive discounts, offers, and other perks.

On the other hand, cashback rewards allow you to receive a percentage of your purchases back as cash. This can be particularly beneficial if you're a frequent shopper or have recurring expenses. Cashback programs can vary significantly, so it's wise to read the fine print. For instance, some may offer 5% cashback on categories like groceries or fuel, while others might have a flat rate for all purchases. To make the most out of these programs, consider combining loyalty tiers with cashback; for example, being a Platinum member may allow you to earn higher cashback rates, creating a powerful synergy between the two systems.

Counter-Strike is a tactical first-person shooter game that has captivated millions of players around the world. It emphasizes teamwork and strategy, making it a popular choice for competitive gaming. Players can enhance their gaming experience by using various in-game benefits, including those offered through clash promo code options that provide exciting bonuses and rewards.

How to Maximize Your Earnings: Strategies for Climbing Loyalty Tiers

Maximizing your earnings through loyalty programs requires a strategic approach to climbing the various loyalty tiers. First, it's essential to understand the specifics of the loyalty program you're participating in. Each program has its unique structure, including the criteria for earning points, rewards for each tier, and how to maximize your return on investment. Begin by setting clear goals for the loyalty program, such as achieving the next tier within a specific timeframe. This focus will allow you to develop a plan tailored to your spending habits. Consider the following strategies:

- Utilize promotional offers and bonuses to accelerate point accumulation.

- Make all eligible purchases through the loyalty program to earn extra points.

- Refer friends or family members to join, which can often yield referral bonuses.

Additionally, engaging with the loyalty program community can enhance your experience and earnings. Stay informed about special events, limited-time offers, and updates by subscribing to newsletters or following the program's social media channels. Another effective strategy is to analyze your spending patterns to maximize your points. Identify which categories yield the most points and focus your spending accordingly. For instance, if a program awards extra points on travel bookings, consider consolidating your trips to that provider. Lastly, keep track of your status and tier benefits, ensuring you’re leveraging every opportunity that comes your way:

- Regularly review your points balance and tier status.

- Redeem points strategically for maximum value.

- Participate in surveys or feedback initiatives that can earn you additional points.

Are Loyalty Programs Worth It? A Deep Dive into Cashback Benefits

Loyalty programs have become a prevalent strategy for businesses looking to enhance customer retention, but the real question is: are loyalty programs worth it? One of the most appealing aspects of these programs is the cashback benefits they offer, which can provide customers with tangible savings on their purchases. For instance, many retailers and credit card companies now offer cashback on every purchase, which accumulates over time. This system not only incentivizes spending but also rewards consumers for their loyalty. A recent study indicated that shoppers who actively engage with cashback programs can save an average of 10-20% on their annual expenses, making this a compelling reason to participate in such programs.

However, it's essential to approach loyalty programs with some scrutiny. While the allure of cashback benefits is undeniable, not all programs are created equal. Factors such as expiration dates, spending thresholds, and hidden fees can diminish the value of these rewards. Customers should carefully read the terms and conditions before enrolling in a loyalty program to ensure they can genuinely benefit from it. Additionally, maintaining a budget and tracking your spending can maximize the advantages of cashback rewards, turning what seems like a simple loyalty initiative into a savvy financial strategy.